In sales made through the Logistics Warehouse, if you do not produce the product you sell (if you do not own the production facility and production line of the product), tax is deducted at the tax rate determined for each product over the sales price.

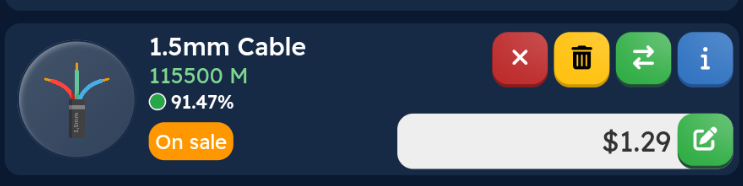

Below is an illustration of the visual representation that a player would encounter when selling a product from the Logistics Warehouse that is not being produced.

You want to sell 1.5mm Cable product, which you do not have a production line, through Logistics Warehouse. The tax rate of this product in the market is determined as 10%. (You can view the tax rates of all products on the market status page.)

In this case

- When you sell the product, you will owe 10% of your sales amount in tax.

- For example: If you sell 1.5mm Cable for $10,000, you will owe $1,000 in tax to the Tax Office.

Note: The tax system in our game has nothing to do with real tax systems. It is built according to in-game dynamics.